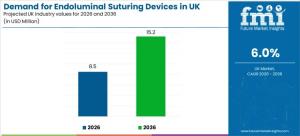

UK Endoluminal Suturing Devices Market Forecast to Reach USD 15.2 Million by 2036

UK demand for endoluminal suturing devices is projected to grow at a 6.0% CAGR, driven by bariatric and minimally invasive care adoption.

NEWARK, DE, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Demand for endoluminal suturing devices in the United Kingdom is projected to reach USD 8.5 million in 2026 and expand to USD 15.2 million by 2036, reflecting a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The market’s growth is being shaped by hospital endoscopy units, bariatric service lines, gastroenterology teams, ambulatory surgery centers (ASCs), and specialty clinics as they integrate minimally invasive closure technologies into routine clinical workflows. These day-to-day procedural planning decisions—covering equipment selection, staff training, and workflow standardization—define the long-term demand trajectory for endoluminal suturing systems across the UK.

Request For Sample Report | Customize Report |purchase Full Report - https://www.futuremarketinsights.com/reports/sample/rep-gb-31639

Market Overview: What Is Driving Demand and Where Growth Is Concentrated

• Endoluminal suturing devices are used to enable secure tissue approximation and closure during endoscopic procedures, particularly in bariatric interventions and gastrointestinal repairs. Adoption is primarily influenced by closure integrity, repeatability, usability in narrow anatomical spaces, and the ability to maintain predictable outcomes across different operators.

• Hospitals remain the leading end-user segment, accounting for 39.3% of total demand in 2026. Their position reflects higher procedural complexity, access to multidisciplinary care teams, and structured training and credentialing systems that support consistent outcomes. Ambulatory surgery centers and specialty clinics also contribute to adoption, particularly where shorter stays and faster scheduling cycles favor minimally invasive approaches.

• Regionally, England leads market expansion with a forecast CAGR of 6.6% from 2026 to 2036, supported by higher procedural throughput, larger hospital networks, and greater density of specialist bariatric and gastrointestinal programs. Scotland follows at 5.9%, Wales at 5.5%, and Northern Ireland at 4.8%, reflecting more measured adoption aligned with phased capability development and training readiness.

Product and Application Segmentation: How Clinical Priorities Shape Adoption

Needle-based suturing devices are expected to dominate the UK market with a 55.0% share in 2026, making them the leading product type. Clinical teams favor these systems for their controlled tissue capture, predictable stitch placement, and handling stability, particularly where closure integrity is a primary procedural success factor. Hospitals also value needle-based systems for their ability to support standardized training pathways and reduce outcome variability between operators.

By application, bariatric procedures account for 41.0% of total demand, positioning them as the largest clinical use case for endoluminal suturing devices in the UK. Closure stability is a critical determinant of post-procedure safety and recovery in bariatric interventions, driving clinician preference for devices that deliver consistent performance and minimize complication risk. Gastrointestinal repairs represent another significant application segment, where secure closure directly influences patient outcomes and procedural confidence.

Regulatory and Clinical Context: Why Procurement Discipline Is Increasing

Demand growth is occurring alongside heightened regulatory and governance expectations. UK government guidance has introduced strengthened post-market surveillance requirements for medical devices in Great Britain, with new measures coming into force on June 16, 2025. These requirements emphasize improved incident traceability and trend monitoring, increasing the importance of supplier documentation quality, training readiness, and service responsiveness in procurement decisions.

Clinical leaders are also aligning endoluminal suturing capabilities with broader endoscopic closure strategies, integrating suturing systems with clips and other closure tools within standardized procedural kits. This integration supports technique consistency, reduces workflow variability, and strengthens adoption across large hospital networks and specialist centers.

Market Dynamics: Opportunities, Constraints, and Risk Factors

The primary growth driver is the expansion of minimally invasive care pathways, particularly in bariatric and gastrointestinal procedures where reliable closure outcomes support faster recovery and reduced procedural trauma. NHS Digital’s National Obesity Audit reporting, which tracks bariatric activity in England, reinforces the operational need for procedure-ready tools that clinicians can deploy with confidence.

However, training and skill standardization remain key constraints. Endoluminal suturing outcomes are sensitive to operator technique, and facilities must invest in structured onboarding and workflow alignment to achieve consistent results. Budget prioritization also affects purchasing timelines, especially where endoscopy imaging upgrades and service-line expansion programs compete for capital allocation.

Opportunities are strongest where suppliers provide structured training support, troubleshooting pathways, and responsive service models that protect device uptime. Conversely, inconsistent closure outcomes, accessory supply continuity issues, and evolving regulatory documentation requirements represent potential threats to sustained adoption.

Competitive Landscape: Who Is Competing in the UK Market

The UK endoluminal suturing devices market includes Boston Scientific Corporation, Medtronic, Olympus, Ovesco Endoscopy AG, and EndoRobotics Co., LTD. Competition centers on clinician usability, closure reliability, training support, and supplier responsiveness. Hospitals and specialty centers evaluate vendors based on handling predictability, time efficiency in real-world procedures, and the ability to scale adoption beyond small expert user groups.

Outlook Through 2036

With demand forecast to nearly double from USD 8.5 million in 2026 to USD 15.2 million in 2036, the UK endoluminal suturing devices market is expected to expand steadily as minimally invasive closure pathways become further embedded in bariatric and gastrointestinal care. Growth will remain closely linked to procedural throughput, regulatory compliance readiness, and the ability of healthcare providers to standardize technique and training across diverse clinical settings.

Browse Related Insights

Animal Immunoassay Kits Market: https://www.futuremarketinsights.com/reports/animal-immunoassay-kits-market

Nano Suspension Market: https://www.futuremarketinsights.com/reports/nano-suspension-market

NRG1 Fusion-Targeted Therapy Market: https://www.futuremarketinsights.com/reports/nrg1-fusion-targeted-therapy-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.